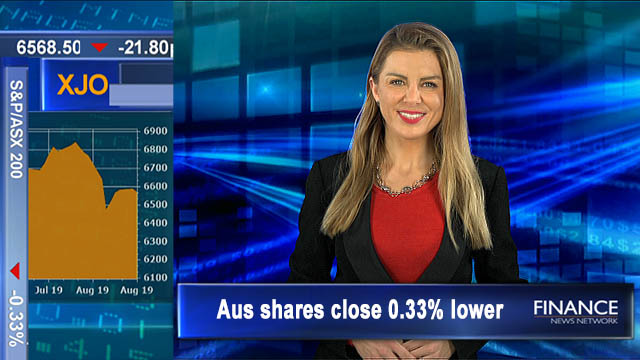

ASX snaps four-day winning streak but gold shines bright: Aus shares close 0.3% lower

The Australian share market broke its four-day winning streaking, closing 0.3 per cent lower today. The benchmark ASX200 opened lower as expected and continued to lose momentum throughout the session.

Several factors were a play today; all the three major indices on Wall Street notched losses of 1.2 per cent or more on Monday as bonds there (the benchmark 10-year Treasury yield) are at 2016 year lows. Major banks like Bank of America and Goldman Sachs lost over 2 per cent. Meanwhile moving around the globe, Hong Kong’s anti-government protests have intensified. While over in Argentina, the surprise primary election result saw its local stock market fall 35 per cent and the currency slide 25 per cent against the USD.

But there was still plenty of green on the screen. Gold players like Evolution Mining (ASX:EVN) and St Barbara (ASX:SBM) rose 2, while Iron ore major FMG (ASX:FMG) rose 3.6 per cent.

The benchmark index is now about 4.2 per cent off the all-time high set in late July. At the closing bell the S&P/ASX 200 index closed 22 points lower to finish at 6,569.

Futures market

Dow futures are suggesting a rise of 35 points.

S&P 500 futures are eyeing a rise of 4 points.

The Nasdaq futures are eyeing a rise of 13 points.

And the ASX200 futures are eyeing a 0.6 per cent fall tomorrow morning.

Economic news

NAB released its business survey for July, revealing below average confidence and conditions. Conditions lost significant momentum since early 2018, with no improvement on the cards in the near term. NAB also noted confidence ticked up after a sharp fall in May and a period of volatility amid the federal election, however confidence and conditions are below long-term averages.

Company news

Construction company, Johns Lyng Group (ASX:JLG) has snapped up a controlling stake in Sydney based strata and facilities management business, Bright & Duggan Group. The company and its brands have over 55,000 strata titled units under management. $13.8 million will be paid in cash for 51 per cent voting power and a 46 per cent economic equity interest. The purchase is set to contribute revenue in the order of $31 million and EBITDA of $4.5 million in FY20. Shares in Johns Lyng Group (ASX:JLG) closed 4.2 per cent higher at $1.61. Its shares are trading 31.89 per cent per cent higher YOY.

Australia’s largest annuity provider, Challenger (ASX:CGF) shares hit a two month high today despite the company announcing its earnings growth for the FY19 were impacted by lower investment earnings and performance fees. Normalised net profit before tax (NPBT) was grew $1 million to $548 million, in line with the revised guidance (provided in January 2019). Its statutory net profit after tax fell $4.6 per cent to $308 million on the impacts to the financial advice industry. Over the month CGF share are up 5 per cent, YOY its 44 per cent lower on the back of the royal commission.

Magellan Financial Group (ASX:MFG) announced its net profit after tax soared 78 per cent in financial year 2019 to $376.9 million. Its 6-month dividend was 111.4 cents per share, while its final dividend was 78.0 cents per share, plus there was a performance fee dividend of 33.4 cents per share. Meantime, the fund manager announced the launch of Magellan High Conviction Trust and plans to raise $275 million.

Investment manager, Centuria Capital Group (ASX:CNI) reported a rise in its annual operating profit after tax (for the year ending 30 June 2019), with profit hitting $45.7 million, up from $45.1 million in the prior corresponding period. Its property funds management profit rose 13 per cent. Year-on-year its shares are up 46 per cent and it’s about to get a lot more interest as it nears the inclusion into the ASX300, which will see index funds have to compulsorily buy its shares. For more on Centuria’s co CEO John McBain discuss the results.

Best and worst performing sectors

The best performing sector was Information Technology, adding 0.7 per cent while the worst performing sector was Health Care, shedding 1.2 per cent.

The best performing stock in the S&P/ASX 200 was Fortescue Metals Group (ASX:FMG), rising 3.6 per cent to close at $7.22. Shares in Aurizon Holdings (ASX:AZJ) and Skycity Entertainment Group (ASX:SKC) followed higher.

The worst performing stock in the S&P/ASX 200 was Orocobre (ASX:ORE), dropping 6.4 per cent to close at $2.63. Shares in CYBG (ASX:CYB) and Galaxy Resources (ASX:GXY) followed lower.

Asian markets

Japan’s Nikkei has lost 1.1 per cent, Hong Kong’s Hang Seng has lost 1.8 per cent and the Shanghai Composite has lost 0.7 per cent.

Commodities and the dollar

Gold is trading at US$1,520 an ounce.

Iron ore price is trading flat at US$94.12.

Iron ore futures are pointing to a rise of 0.6 per cent.

Light crude is US$0.28 up at US$54.78 a barrel.

One Australian dollar is buying 67.62 US cents.

Copyright 2019 – Finance News Network

Source: Finance News Network