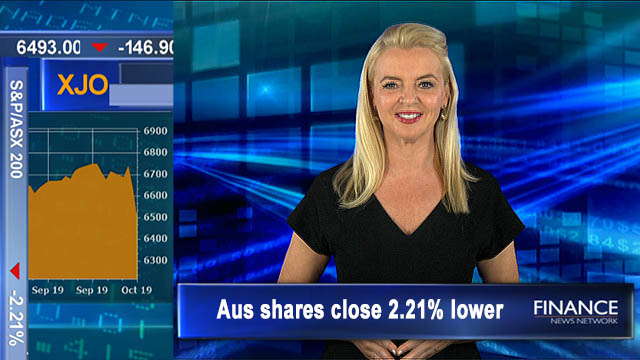

Global stocks fall on economic growth worries: ASX closes 2.2% lower

It has been a disappointing day of trade for the Australian share market. After opening in the black the local bourse failed to gain momentum to close 2.2 per cent lower.

Mayne Pharma (ASX:MYX) saw their shares drop after a boost yesterday after signing a deal in the US to sell a new contraceptive drug in the States. Ooh!Media (ASX:OML) dropped today as did Nearmap (ASX:NEA). As for the sectors, Utilities lost the least and Telcos came in bottom of the pile.

The S&P/ASX200 index

At the closing bell the S&P/ASX 200 index closed 147 points lower to finish at 6,493.

Futures market

Dow futures are suggesting a rise of 56 points.

S&P 500 futures are eyeing a rise of 7 points.

The Nasdaq futures are eyeing a lift of 14 points.

And the ASX200 futures are eyeing a 140 point fall tomorrow morning.

Economic news

In trend terms, the balance on goods and services was a surplus of $6.9 billion in August, an increase of $73 million on the surplus in July 2019. In seasonally adjusted terms, the surplus was $5.9 billion, a decrease of $1.3 billion on the surplus in July this year.

Company news

Probiotec (ASX:PBP) has today completed the sale of the Celebrity Slim brand. Probiotec are a manufacturer, packer and distributor of a range of prescription and over-the-counter pharmaceuticals, complementary medicines and consumer health products. The company owns three manufacturing facilities across Australia. Shares in Probiotec (ASX:PBP) closed 2.9 per cent lower at $1.83.

Spark New Zealand (ASX:SPK) confirms that the Southern Cross NEXT transaction has now completed following the satisfaction of all conditions. As a result, Telstra is now a 25 per cent shareholder of the Southern Cross Cable Network and an anchor customer of the Southern Cross NEXT undersea data cable. Shares in Spark New Zealand (ASX:SPK) closed 0.2 per cent lower at $4.21.

Leading agricultural firm Webster (ASX:WBA) has signed a binding agreement to be acquired by Canadian pension fund giant PSP Investments with a proposed takeover offer of $854.

Leader in cellular medicines for inflammatory diseases, Mesoblast (ASX:MSB) has successfully completed a $75 million capital raising via a placement to existing and new Australian and global institutional investors.

Clean Seas Seafood (ASX:CSS) has to delay the opening of its new farm at Fitzgerald Bay, near Whyalla in Queensland. The company missed the operating window to start farming this year after a number of outstanding arrangements had to be resolved in order to resume use of the Point Lowly Marina.

Best and worst performers

The sector losing the least is Utilities dropping 1 per cent while the worst performing sector was Communication services, shedding 3 per cent.

The best performing stock in the S&P/ASX 200 was Saracen Mineral Holdings (ASX:SAR), rising 4.1 per cent to close at $3.58. Shares in Northern Star Resources (ASX:NST) and Newcrest Mining (ASX:NCM) followed higher.

The worst performing stock in the S&P/ASX 200 was Nearmap (ASX:NEA), dropping 5.5 per cent to close at $2.42. Shares in Austal (ASX:ASB) and Ooh!Media (ASX:OML) followed lower.

Asian markets

Japan’s Nikkei has lost 2.1 per cent, Hong Kong’s Hang Seng has lost 0.4 per cent and the Shanghai Composite is closed.

Commodities and the dollar

Gold is trading at US$1,503 an ounce.

Light crude is US$0.17 down at US$52.47 a barrel.

One Australian dollar is buying 67.14 US cents.

Copyright 2019 – Finance News Network

Source: Finance News Network