Wall St falls, Who exits & replaces top 200 in Dec, WOW rated as underperform: ASX to lift

Wall St falls shook up by weak jobs report figures amid Omicron angst as market participants fear the Fed will pick up monthly taper pace. Didi shares slump on NYSE on plans to delist. European markets fall on ripple woes. ASX falls for 4 weeks in a row. Credit Suisse caution investors on Woolworth’s bid to acquire Priceline owner rating Woolies as an underperform.

The Australian sharemarket is opening the week on a muted note, the SPI futures are pointing to a gain of 0.2 per cent.

US stocks fall dragged lower by tech

Wall St closed in the red on Friday led by tech tumbling, capping off a volatile week amid the spread of the new Omicron variant. There are also looming questions for what this means for Wall St, the Federal Reserve, and even our pocket.

Uncertainty weighs as the World Health Organization said that the new variant is confirmed in 38 countries, with preliminary data showing that the new strain is even more contagious than the Delta variant. Health officials in South Africa, where the strain first emerged, said that they haven't seen a rise in deaths, but they’re seen a spike in hospitalizations. These concerns were a catalyst that turned the stock market lower last week.

Soft job growth shakes market ahead of Fed meeting

The weakness in the markets were compounded by a softer than expected jobs report which missed expectations by quite a bit. Jobs growth slowed in a month where holiday hiring would be at its peak as retailers look to ramp up their in-store presence. But in November, the economy only added 210,000 jobs, a huge miss from expectations of 550,000. The unemployment rate came in at 4.2 per cent from 4.6 per cent, better than expected, however the participation rate improved to 61.8 per cent from 61.6, the highest level since March last year, the start of the pandemic.

Despite the headline coming in at miss, the key movement in the jobs report was the participation rate. In the past two months it remained unchanged as Americans chose to sit on the fence versus participate in looking for a job or gain employment.

The Federal Reserve is due to meet on the 15th of this month, and this report is one that they watch closely. The central bank could take this outcome as a positive one with the participation rate not far from its February 2020 figure of 63.3 after its improvement in November, with analysts predicting that we will see a faster monthly taper.

What Omicron data will help tame volatility?

Until we gain clarity over the variant, more volatility is on the cards. So you might ask, what clarity are we looking for? We want to know how contagious this variant is, how effective are the vaccines, and how severe is this strain. Until we get a fuller picture, concerns weigh if this will hinder economic recovery, though the cadence of the Omicron spread is already giving us a nervous hint.

Wall St, bond yield falls as investors wait for Fed policy error

At the closing bell, the Dow Jones lost 0.2 per cent to 34,580, the S&P 500 fell 0.8 per cent to 4,538 while the Nasdaq closed 1.9 per cent lower at 15,085.

Over the week, the Dow fell 0.9 per cent, the S&P 500 lost 1.2 per cent, and the Nasdaq dived 2.6 per cent.

Across the S&P 500 sectors, there were eight losers to three winners.

Consumer discretionary was the worst performer, down 1.8 per cent weighed down by travel, and cruise line stocks, followed by information technology, financials, and energy. Consumer staples fared well, up 1.4 per cent, followed by utilities, and healthcare.

Six months after IPO Didi exits Wall St & moves to HK

Shares in Didi slumped over 22 per cent after the company said that they will be delisting from the New York stock exchange and list in Hong Kong. Shares slumped 44 per cent since its IPO in June. This is the company that took the title of the biggest IPO in the world. Reports of regulators in China asked the company to delist in the US. Didi said that they decided to delist after “careful consideration”. It’s been under regulatory scrutiny since going public before solving public security concerns.

CEO Elon Musk continues to submit regulatory filing to sell his Tesla stocks. Musk has unloaded more than US$10 billion in stock. Shares in Tesla closed 6.4 per cent lower.

Bond yield jumpy as uncertainty weighs

The yield on the 10-year treasury note was jumpy during the session, and the same for their 2-year treasury note. Market participants piled into government bonds, with the yield on the 10-year lower by 10 basis points to 1.34 per cent, while gold rose on a firmer greenback.

Quick note on this, you might be wondering what happened in bond markets. Investors are expecting the Federal Reserve to hike interest rates next year amid hot and persistent inflation. Fixed income investors are priming themselves for the central bank to make an error around the monetary policy, or see the number of rate hikes be less than anticipated, that’s why the performance was bumpy.

European markets falls despite strength in retail sales

Across the Atlantic, European markets closed lower despite Eurozone’s retail sales growing 0.2 per cent in October after falling 0.4 per cent the month before according to Eurostat. This is on the backdrop of hot inflation with Germany hitting 6.0 per cent in November adding pressure to the ECB. For now, the European Central bank has maintained its ‘transitory’ inflation stance.

Paris lost 0.4 per cent, Frankfurt fell 0.6 per cent and London’s FTSE lost 0.1 per cent as energy stocks offset losses in miners. Rio Tinto tumbled 3.0 per cent, BHP fell 2.7 per cent, while oil giants BP rose 1.3 per cent, and Royal Dutch Shell added 0.8 per cent.

Asian markets mixed as China’s services grows at slower pace

Asian markets closed mixed after China’s services sector grew at a slower pace in November from Caixin. The PMI came in at 52.1, down from 53.8 in October. Tokyo’s Nikkei gained 1.0 per cent, Hong Kong’s Hang Seng fell 0.1 per cent amid Didi’s intent to list, while China’s Shanghai Composite added 0.9 per cent.

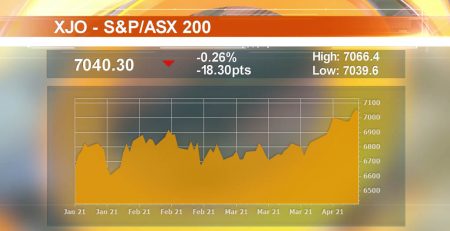

ASX 200 falls for 4-straight weeks

On Friday, the Australian sharemarket closed 0.2 per cent higher at 7,241, but declined for its fourth week in a row. Over the year, the index rose 9.9 per cent.

Let’s review the best and worst performing stocks over the week.

Worley (ASX:WOR) topped the leader board with a surge of 13.6 per cent after its investor day last week. This prompted a number of brokers to upgrade its rating. Morgan Stanley believes the engineering company will be a beneficiary of the energy transition and feels that the macroeconomic indicators of activity are improving. The broker boosted its target price to $12 from $11 and its rating to overweight. Shares in Worley (ASX:WOR) closed 2.0 per cent higher at $10.28.

Regis Resources (ASX:RRL) sank 13 per cent amid the price of gold pulling back after Omicron arrived. From a fundamentals perspective, the gold miner reaffirmed its full-year production guidance and all-in sustaining cost at October end. The miner felt the pain from the lockdowns, high staff turnover and lower output. The retreat in the price of the precious metal is going to make it harder for the miner to hit the lower end of their full year guidance. Shares closed 2.6 per cent lower at $1.68.

For a wrap up of Friday’s session, join me here.

Local economic news

It’s going to be a big week around central banks meeting and inflation figures.

Kicking off with ours today, we are expecting inflation gauge results from the Melbourne Institute, along with the job advertisements data from ANZ.

The RBA board meets tomorrow to discuss monetary policy. India, Brazil, Canada central banks meet on Wednesday, on Thursday China is slated to release inflation figures for November while the US has theirs due on Friday.

December quarter rebalance

Details of the December quarterly rebalance has been released with five companies set to bump in and five companies set to exit.

Kogan.com Ltd (ASX:KGN), Monadelphous (ASX:MND), Nearmap Ltd (ASX:NEA), Omni Bridgeway (ASX:OBL), and Redbubble (ASX: RBL) are slated to leave the ASX 200 effective prior to the open of the 20 December this year.

A few names replacing them are Paladin Energy (ASX:PDN), Imugene (ASX:IMG).

Click here for the full list.

Broker moves

Credit Suisse rates Woolworths (ASX:WOW) as underperform with a price target of $31.84. The supermarket giant has entered the battle to acquire Australian Pharmaceutical Industries (ASX:API) with an offer of $1.75 per share bid, more than the $1.55 per share offer by Wesfarmers (ASX:WES). The analysts have asked investors to ponder the group's inglorious past attempts to expand their portfolio, however, they note the estimated $990 million cost is not material. Shares in Woolworths (ASX:WOW) closed 1.0 per cent lower to $39.59 on Friday.

Ex-dividend

There is one company trading ex-dividend today. Collins Foods (ASX:CKF) is trading 12 cents fully franked.

AGMs

There are three companies set to meet with shareholders.

Intega Group (ASX:ITG)

Pointerra (ASX:3DP)

Vection Technologies (ASX:VR1)

Trading updates/Interim reports

Metcash (ASX:MTS)

IPOs

There are three companies are set to list on the ASX today including Australian Bond Exchange Holdings (ASX:ABE), Larvotto Resources (ASX:LRV) and Newmark Property REIT (ASX:NPR) after raising $128.3 million.

Commodities

Iron ore has gained 0.7 per cent to US$102.36. Its futures point to a 3.6 per cent gain.

Gold gained $21.20 or 1.2 per cent to US$1,784 an ounce, silver was up $0.17 or 0.7 per cent to US$22.48 an ounce.

Oil fell $0.24 or 0.4 per cent to US$66.26 a barrel.

Currencies

One Australian Dollar at 7:30 AM has weakened from Friday, buying 70.09 US cents (Fri: 70.90), 53.04 Pence Sterling, 79.10 Yen and 62.02 Euro cents.

Copyright 2021 – Finance News Network

Source: Finance News Network