Volume

The Basics

Volume is used to quantify trading activity each period in a market, market sector, or individual instrument. It can be added as an underlay on the chart or in a separate window.

Indicator Type

Activity indicator

Markets

All cash, futures and options although futures and forex may substitute end of day summaries and trade count data.

Works Best

All markets and all-time frames.

Parameters

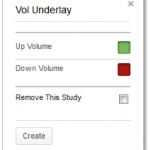

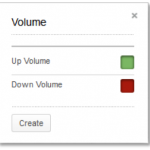

There are no parameters to select for either the Volume or Vol Underlay indicators in Technician.

You can select colour for the volume plot a by selecting the boxes next to each to bring up a colour palette. Volume is measured “close” to “close” (rather than “open” to “close) so all volume for a period that has a net positive price change is considered to be “up volume.”

To remove the study from the chart, click the “remove this study” check box. It will only appear if the study is already on the chart.

Theory

Volume is simply the number of shares, contracts, or units changing hands in a given period (day, week, hour). It is reported in real-time (or delayed) with each trade. Markets that do not have trade-by-trade reported volume substitute daily summary data or trade count data. Trending markets should be accompanied by rising volume. Exhausted markets are usually accompanied by falling volume or unusually high-volume spikes.

Interpretation

When prices are rising, volume should also be rising. This indicates that more bulls are entering the market and market momentum is strong. If it begins to flatten or fall, a divergence is set up and may indicate that the market is nearing a turning point.

When prices are falling, the converse is not exactly true. Volume can be falling or steady. Typically, market participants are less active in bear markets. If volume begins to increase, it does not signal an immediate reversal, but usually one is near.

Volume can confirm or deny a reversal or breakout condition. If the market registers a one-day reversal on high volume, the change in market trend is likely. Similarly, when the market breaks out of a consolidation pattern on high volume, the breakout becomes more valid.

There were signs available to be read when CSL peaked in 2014. Here we see the CSL score a higher high in price but a lower high in volume on its very last push. When the trendline broke down, volume soared to confirm that a significant change had occurred. Later, we can see a bullish divergence in volume as price made a lower low. Keep in mind that volume divergences are more meaningful at tops rather than bottoms.